The Small Business Owner's Guide to Choosing Between LLC, S-Corp, and C-Corp Status

Introduction

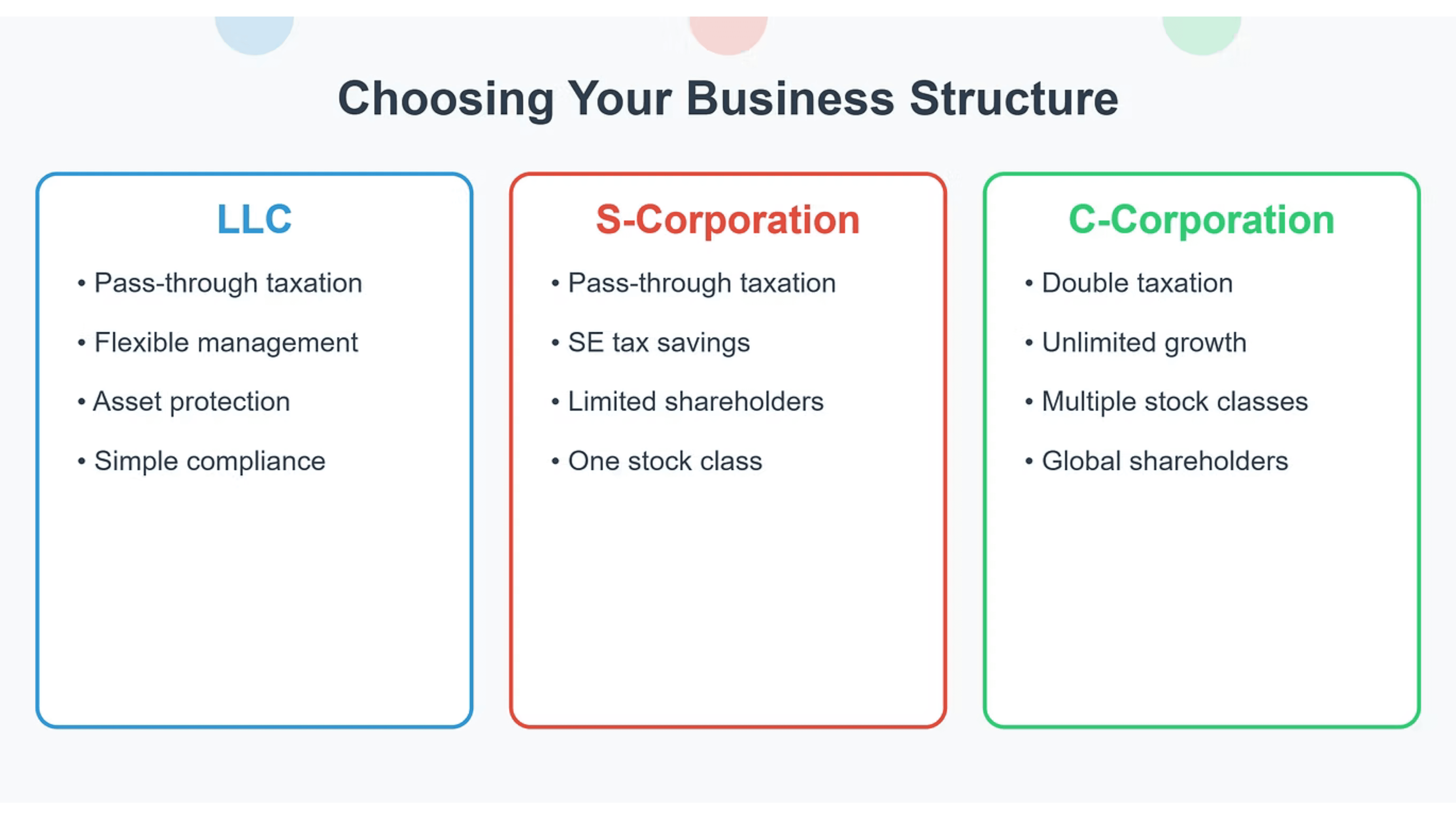

Selecting the right business structure is one of the most crucial decisions you'll make as a business owner. This choice impacts everything from your tax obligations to your personal liability and ability to raise capital. Let's explore each option in detail to help you make an informed decision.

Limited Liability Company (LLC)

Tax Implications

An LLC offers remarkable flexibility in taxation. By default, single-member LLCs are treated as sole proprietorships, and multi-member LLCs are treated as partnerships for tax purposes. However, LLCs can elect to be taxed as either an S-corporation or C-corporation.

Key Benefits

Pass-through taxation (profits and losses pass directly to personal tax returns)

Flexible profit distribution among members

Less rigid compliance requirements

Protection of personal assets from business liabilities

No restrictions on ownership

Potential Drawbacks

Self-employment taxes on all profits

May have limited life in some states

More difficult to raise capital through stock sales

Variable state filing requirements

S-Corporation

Tax Implications

S-corporations are pass-through entities, meaning profits and losses flow through to shareholders' personal tax returns. A key tax advantage is the ability to split income between salary and distributions, potentially reducing self-employment taxes.

Key Benefits

Avoid double taxation

Potential savings on self-employment taxes

Personal asset protection

Easier transfer of ownership through stock sales

Established legal structure with extensive case law

Potential Drawbacks

Strict eligibility requirements:

Limited to 100 shareholders

Shareholders must be U.S. citizens/residents

Only one class of stock allowed

More complex compliance requirements

Must pay reasonable compensation to owner-employees

C-Corporation

Tax Implications

C-corporations face double taxation: the corporation pays taxes on profits, and shareholders pay taxes on dividends. However, they offer the most tax-deductible business expenses and can retain earnings for growth.

Key Benefits

Unlimited growth potential through stock sales

Strongest liability protection

Ability to offer multiple classes of stock

No restrictions on ownership

Full deduction of employee benefits

Can retain earnings at corporate tax rates

Potential Drawbacks

Double taxation on distributed profits

Higher formation and maintenance costs

Complex regulatory requirements

More expensive accounting and legal needs

Making Your Decision: Key Considerations

Consider an LLC if:

You want flexibility in taxation and management

You're a small to medium-sized business

You want simpler compliance requirements

You don't plan to seek external investors

Consider an S-Corp if:

You want to save on self-employment taxes

You meet the ownership restrictions

You want the benefits of incorporation with pass-through taxation

You plan to sell the business in the future

Consider a C-Corp if:

You plan to seek venture capital or go public

You want to offer multiple classes of stock

You need to retain significant earnings in the business

You plan to have international shareholders

Tax Planning Strategies

LLC Tax Strategies

Consider electing S-corp taxation to save on self-employment taxes

Maximize pass-through deductions under Section 199A

Structure operating agreements to optimize tax distribution

S-Corporation Tax Strategies

Balance salary vs. distributions to minimize payroll taxes

Time distributions carefully for tax efficiency

Utilize shareholder basis planning

C-Corporation Tax Strategies

Maximize deductible business expenses

Consider qualified small business stock treatment

Plan dividend distributions strategically

Final Considerations When Choosing Between LLC, S-Corp, and C-Corp Status

The optimal business structure depends on various factors:

Current and projected revenue

Number of owners/investors

Growth plans

Exit strategy

State of operation

Industry regulations

It's crucial to consult with qualified tax and legal professionals before making your final decision. They can help you understand the specific implications for your situation and ensure compliance with all requirements.

Remember that your business structure isn't permanent – you can change it as your business evolves, though there may be tax implications for doing so.

Next Steps

1. Assess your business goals and financial projections

2. Consult with tax and legal professionals

3. Compare formation and ongoing compliance costs

4. Review state-specific requirements

5. Consider future business plans and exit strategies

Making an informed decision about your business structure now can save significant time and money in the future while providing the framework for sustainable growth and success.

Disclaimer

This guide provides general information and should not be construed as tax or legal advice. Please consult with qualified professionals for advice specific to your situation.